Blog > What is a High Risk Merchant Account?

What is a High Risk Merchant Account?

A high risk merchant account is a special merchant account created expressly for merchants deemed high risk; the merchant account makes it possible for those types of merchants to accept credit cards just like any other business would. Processing markups may be higher than average with a high risk merchant account, as processors may want more money to use to protect themselves in the event something bad happens to your business.

Why is your business considered high risk?

A business or industry will typically be considered high risk if it’s involved with a good deal of chargeback activity. (Chargebacks are undesirable for everyone–you as a business owner, your customer, and your processor. Processors get reprimanded sternly–in the form of a fine–if they take on too many chargebacks, so, to curb the potential for a big fee at the end of the month or the year, some processors elect to charge more.) Thus, if your industry’s processing typically involves a higher number of chargebacks, the fees for that industry will typically be higher.

What to expect as a high risk merchant

High risk processing doesn’t come without risks which is why some processing companies will impose precautionary measures on high risk merchant accounts.

These precautionary measures may include:

- An extensive application process

- Inflated payment processing fees

- Revenue reserves

- Increased chargeback rates

- Supplemental requirements and restrictions

Extensive application process

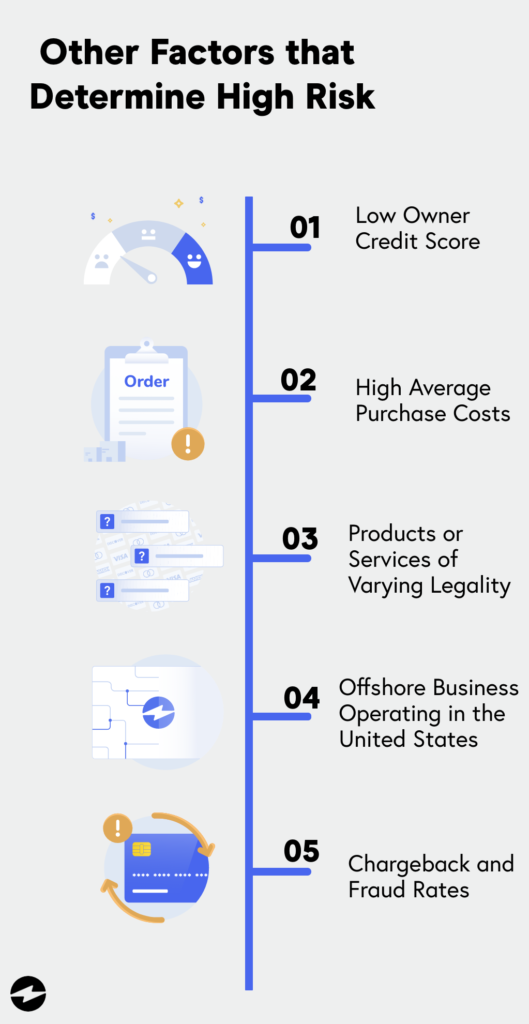

When applying for a high risk merchant account, the merchant service provider may ask for detailed information to gain a better understanding of the level of risk your merchant account poses.

The merchant service provider will assess this risk based on patterns found in your finances and by checking your business’s processing history, current or past partnerships, and in some cases, your personal credit history to check for a history of bad credit.

Inflated payment processing fees

While the average small business may be paying processing fees around 0.3% over the rate of interchange, high risk merchant accounts can accrue up to 1.5% on top of the current interchange rate. Although these rates may vary, high risk merchant accounts typically always come with higher fees.

Revenue reserves

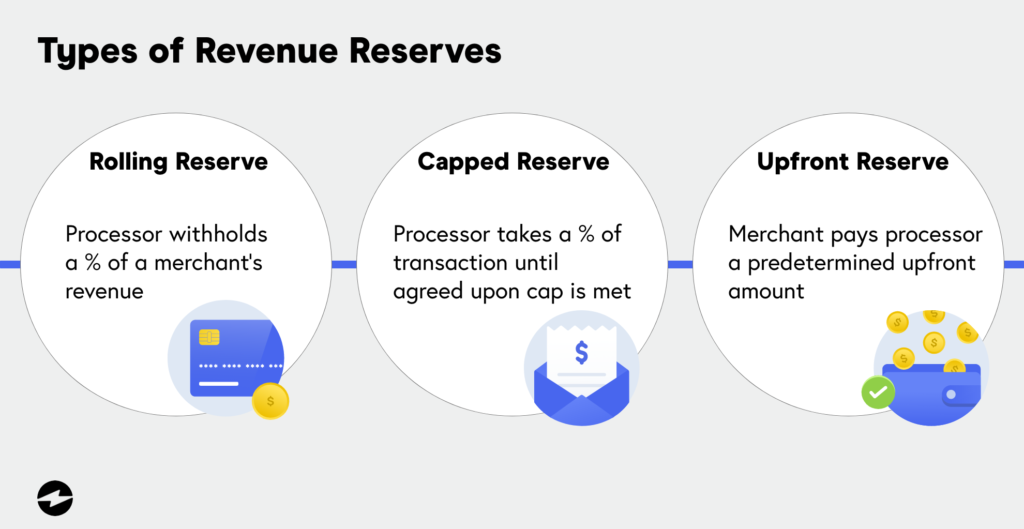

It’s not uncommon for processing companies to hedge portions of revenue from high risk businesses, also known as reserve funds. Here are some of the ways that processing companies will do this:

- Rolling reserve: This means the high risk payment processor will hold a predetermined percentage of the merchant’s revenue in an account without charging interest on those funds. The funds are held for a specific amount of time before being returned to the merchant’s account.

- Capped Reserve: This means that the high risk merchant processor extracts a predetermined percentage of each transaction until the overall amount reaches the capped amount specified by the processor. Once that total has been reached, the processor will cease extracting a percentage from each transaction but the overall amount that’s already been taken out will be kept by the processor.

- Upfront reserve: This is when high risk processors require the merchant to pay a predetermined amount upfront. The processor can even bar the high risk merchant from accepting any transactions until this amount is paid in full.

Increased chargeback rates

Dealing with chargebacks is never a fun process, especially for high risk merchants. Merchants with high chargeback ratios will likely have to deal with higher chargeback rates. While these rates may vary depending on the level of risk the merchant account poses, the extra fees attached to each chargeback can add up quickly.

Supplemental requirements and restrictions

High risk merchant accounts can come with some pesky restrictions. In fact, credit card processors may even restrict you from processing payments after a certain sales volume limit has been reached.

There are numerous factors that can determine the number of requirements a processor will issue your business. For example, if your business is selling a product that can only be sold to customers of a certain age, the processor will require you to use the appropriate tools to ensure only age-appropriate customers are able to purchase said product.

If your processor enforces similar restrictions, it’s imperative to apply the necessary tools and protocols to comply with these restrictions which will assure your processor that you’re operating within legal limits.

Why do chargebacks occur?

In some legitimate cases, a customer will actually lose his/her credit card, not receive a refund for a purchase, or something like that. Mistakes and other uncontrollable events happen. But, a good percentage of the time, customers will initiate a chargeback, simply because they can. Maybe it makes it easier to save face when a certain credit card activity statement arrives. Maybe the item the customer bought took too long to arrive, or, in the intervening period between the purchase and the item’s arrival, someone changed their mind (or changed their plans or itinerary). Here’s a (non-comprehensive) list of some industries that might be considered high risk and why their customers might charge something back.

- Chat or webcam sites (potential for embarrassment on a monthly statement; hard to prove the service was given since it’s intangible)

- Airplane charters (occasional long wait between the charge and the service; plans change)

- Sexual or adult content of any kind (potential for embarrassment)

- Bankruptcy attorneys (embarrassment)

- Limousine service (alcohol sometimes makes parties forget they ordered service at all)

- Gambling (embarrassment)

- Firearms and paraphernalia (banks are sometimes criticized for doing business with these merchants)

- Hypnosis (hard to prove service was rendered)

- High risk investments (good chance of failure; transactions can be very large)

- MOTO businesses (card necessarily isn’t present; easy to falsely say the transaction was fraudulent)

- Vitamins and supplements (hard to prove they’re effective)

And the list just goes on and on… It’s not absolutely a given to be considered high risk, but, obviously, it isn’t something you can easily sidestep.

Finding a payment processor as a high risk merchant

It can be daunting to find a payment processor as a high risk merchant. If you’re a high risk merchant in search of a payment processor, here are a few tips on how to make the process easier for you and the processor:

- Monitor your revenue. Maintaining a healthy amount of revenue in your business’s bank account is a great way to show financial stability which payment processors will find deeply reassuring.

- Try to minimize chargebacks. A few ways to do this are by confirming your cardholder’s identity, clarifying your billing details, documenting all shipping and return policies, utilizing chargeback management tools, and decreasing payment processing costs.

- Be honest. During the application process, it’s imperative to be transparent with any required information. You don’t want to give payment processors any reason to doubt your credibility. Processors will often ask for more detailed information from high risk merchants to assess the level of risk they’re dealing with.

- Keep necessary documents handy. Each processor typically has its own set of requirements when it comes to which documents are needed for examination. It’s important to be aware of these requirements before the application process. Bank statements and tax returns are common documents examined by payment processors, so be sure to have a few years’ worth of these documents handy.

- Be patient. If you’re a high risk merchant, it’s important to remember that payment processors are accepting the risks you bring when they agree to work with you. This is why you should always be patient and compliant with any recommendations the payment processor may have, especially when it comes to reducing the risk factor you bring.

Finding a high risk merchant service provider

Normal merchant accounts will usually be able to find standard pricing for payment processing on the service provider’s website or public platform. Unfortunately, this isn’t usually the case for high risk merchant accounts.

If you’re considered high risk, you’ll likely need to go through a consultation with the payment processing company before getting pricing. Rates will often vary depending on what kind of high risk merchant you are which can dictate how high of a risk you pose.

Stick to the guidelines

While may it seem there are many hoops to jump through as a high risk merchant, you shouldn’t be discouraged. High risk merchant accounts can come with extra baggage and restrictions but businesses in high risk industries can still be successful and profitable if they follow the guidelines put in place by payment processors.

EBizCharge offers merchant services to many high risk industries, providing:

- Accounting system integrations: If you don’t see your customers’ credit cards, you can enter their information directly into your accounting system and be done for the day. We integrate processing with many systems, including QuickBooks, Epicor, Sage 50, Sage 100, and Sage Intacct – as well as systems like Sage 500, Microsoft Dynamics NAV, and SAP Business One.

- Lower costs on business-type cards and government cards: Perfect for B2B or government vendors, as those cards tend to be the most expensive to accept.

- Chargeback management team: Our team will alert you via phone call and email within 24-48 hours when a chargeback occurs, letting you know your best course of action. This doesn’t guarantee a victory, but it probably gives you a much better chance than before.

Summary

- Why is your business considered high risk?

- What to expect as a high risk merchant

- Why do chargebacks occur?

- Finding a payment processor as a high risk merchant

- Finding a high risk merchant service provider

- Stick to the guidelines

- EBizCharge offers merchant services to many high risk industries, providing:

EBizCharge is the leading merchant services solution for high-risk businesses.

EBizCharge is the leading merchant services solution for high-risk businesses.