Works inside popular distribution tools

EBizCharge works directly inside 100+ ERP, accounting, eCommerce and POS systems to collect payments from your customers. No third-party apps needed.

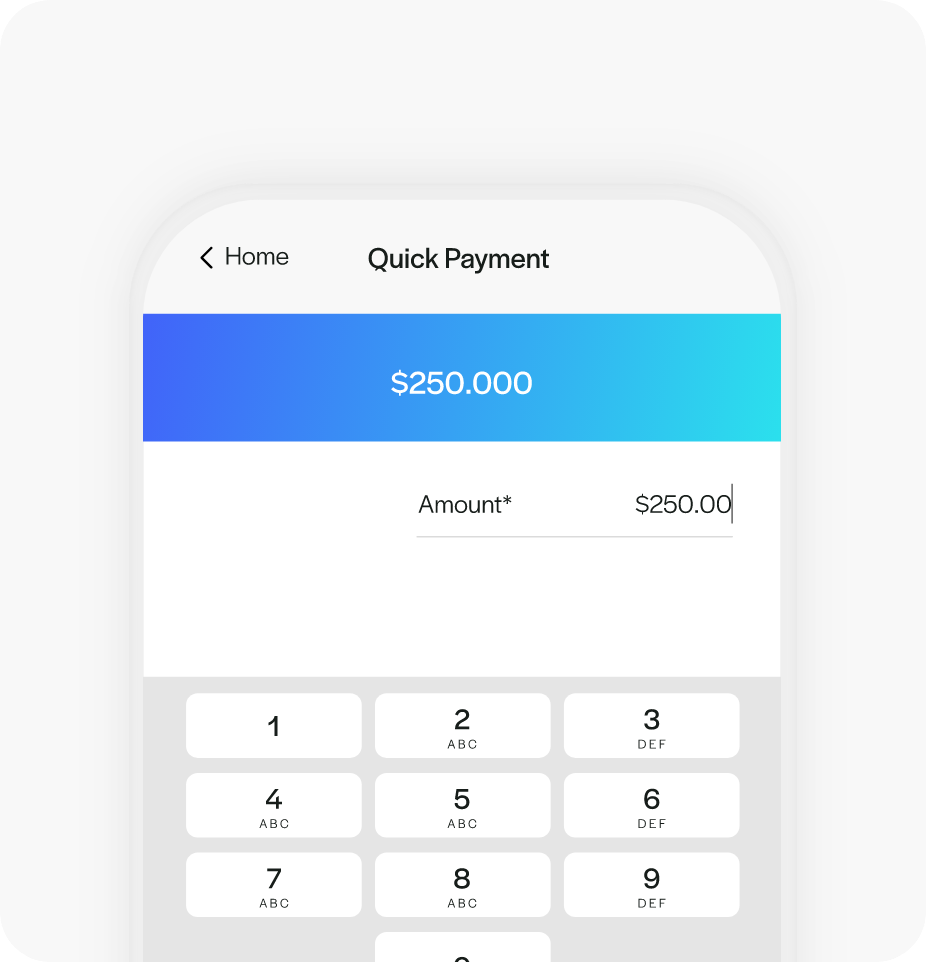

Perfect for card-not-present transactions

EBizCharge features focus on speeding up card-not-present transactions to help your business get paid in full, and faster than ever before.

Reduces security liability

Keep your business safe from fraud. With EBizCharge, you’ll never have to handle credit card data directly – reducing your liability.

We’re trusted by 400,000+ users.

We’re trusted by 400,000+ users.

Get paid faster.

Get paid faster.

Give your customers quick, easy, and secure ways to pay invoices online or in person.

400+ tech and business partners.

400+ tech and business partners.

Explore partnerships →