Powering payments for some of the top companies.

Powering payments for some of the top companies.

From innovative startups to established enterprises.

From innovative startups to established enterprises.

Make it easier than ever for

your customers to pay

Make it easier than ever for your customers to pay

EBizCharge is a certified Intuit QuickBooks Developer.

It doesn’t just stop there.

It doesn’t just stop there.

All features come standard with an EBizCharge account.

Check out what our customers

have to say about us.

Check out what our customers have to say about us.

We’ve given over 400,000 clients, seamless, integrated payment solutions.

“Your support team’s been on it, and they’ve been willing to go the extra mile to ensure that we’re up and running.”

Franklin Shiraki, CFO • Firewire

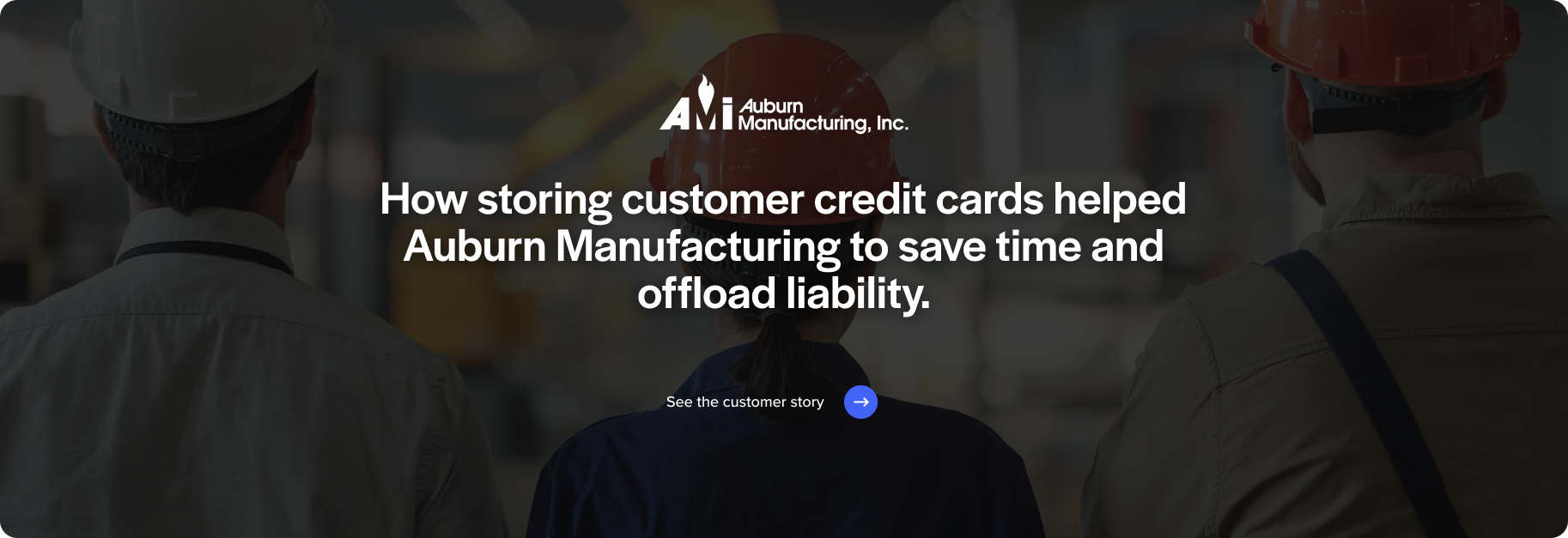

“The software has really helped our customer services staff [and] saved us a lot of time. One of the best assets is that we don’t have to store the credit card information ourselves.

Joy Campbell, Accounting and IT Manager • Auburn Manufacturing