Getting paid has never been easier.

Getting paid has never been easier.

Collect customer payments faster, easier and more securely– all from your existing business tools.

Why 400,000+ users love us.

Why 400,000+ users love us.

Collect payments faster

Collect payments faster

Speed up payment collections using convenient tools like email pay and the customer payment portal.

Automate your receivables

Automate your receivables

Feed transaction data back into your ERP or accounting systems to eliminate manual entry and human error.

Maintain PCI Compliance

Maintain PCI compliance

Eliminate manual management of PCI compliance with our pre-built security modules.

Offer customers easier ways to

pay and start collecting on time.

Offer customers easier ways to pay and start collecting on time.

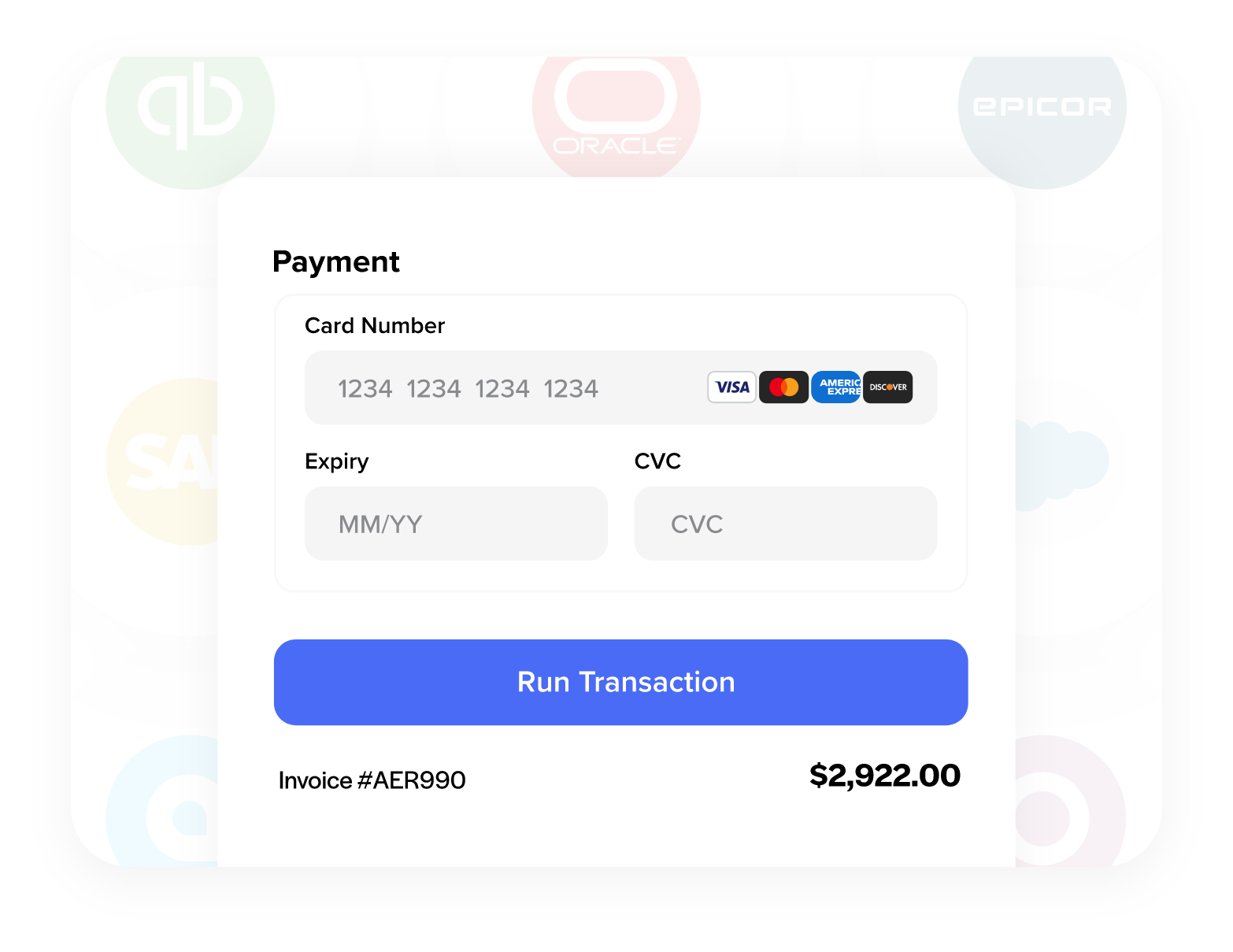

Customers can conveniently pay invoices or sales orders online, by phone, or in-person.

Take payment immediately after an invoice or sales order is created – directly inside your ERP or Accounting system.

Avoid constant phone follow-ups and speed up payment collection by emailing payment links to your customers. Works directly inside your existing invoicing system.

Perfect for repeat customers. Sync invoices to a bill pay portal where customers can view and pay off invoices.

Easily plug the EBizCharge payment gateway into your existing eCommerce shopping cart. There’s absolutely no development needed.

Take payments on invoices straight from your phone. Once a payment is approved, the invoice will automatically sync back to your accounting system as paid.

Run transactions in the office or on the go with our powerful, yet flexible EMV terminals. Easily sync incoming payments into over 100+ business tools you already use to save reconciliation time.

Enroll your customers in automatic payment cycles and easily collect variable statement amounts at the end of each pay period.

Enjoy the capability to create new, recurring payments for customers with any payment option. Have them occur at your set frequency—either within a range of dates or indefinitely.

Want to use EBizCharge as a standalone system? Our Virtual Terminal gives you all the functionality of our toolset in a single cloud platform.

Microsoft Dynamics GP

ERP/Accounting

Salesforce

ERP/Accounting

Magento

eCommmerce

Sage 50

ERP/Accounting

Microsoft Dynamics SL

ERP/Accounting

WooCommerce

eCommmerce

Sage 100

ERP/Accounting

Oracle EBS Financials

ERP/Accounting

Epicor 9

ERP/Accounting

BigCommerce

eCommmerce

Macola

ERP/Accounting

Microsoft Dynamics AX

ERP/Accounting

Sage 500

ERP/Accounting

SAP B1 Cloud

ERP/Accounting

Acumatica

ERP/Accounting

Zen Cart

eCommmerce

Kibo Commerce

eCommmerce

Odoo

ERP/Accounting

Ubercart

eCommmerce

Sana Commerce

eCommmerce

Microsoft Dynamics GP

ERP/Accounting

Salesforce

ERP/Accounting

Magento

eCommmerce

Sage 50

ERP/Accounting

Microsoft Dynamics SL

ERP/Accounting

WooCommerce

eCommmerce

Sage 100

ERP/Accounting

Oracle EBS Financials

ERP/Accounting

Epicor 9

ERP/Accounting

BigCommerce

eCommmerce

Macola

ERP/Accounting

Microsoft Dynamics AX

ERP/Accounting

Sage 500

ERP/Accounting

SAP B1 Cloud

ERP/Accounting

Acumatica

ERP/Accounting

Zen Cart

eCommmerce

Kibo Commerce

eCommmerce

Odoo

ERP/Accounting

Ubercart

eCommmerce

Sana Commerce

eCommmerce

QuickBooks Online

ERP/Accounting

Volusion

eCommmerce

SAP Business One

ERP/Accounting

NetSuite

ERP/Accounting

QuickBooks Desktop

ERP/Accounting

Microsoft Dynamics NAV

ERP/Accounting

Epicor 10

ERP/Accounting

Sage Intacct

ERP/Accounting

Microsoft Dynamics BC

ERP/Accounting

AbleCommerce

eCommmerce

Microsoft Dynamics F&O

ERP/Accounting

SAP B1 HANA

ERP/Accounting

Sage BusinessWorks

ERP/Accounting

nopCommerce

eCommmerce

Miva

eCommmerce

X-Cart

eCommmerce

Web Jaguar

eCommmerce

Dynamicweb

eCommmerce

Zoho Invoice

ERP/Accounting

OpenCart

eCommmerce

QuickBooks Online

ERP/Accounting

Volusion

eCommmerce

SAP Business One

ERP/Accounting

NetSuite

ERP/Accounting

QuickBooks Desktop

ERP/Accounting

Microsoft Dynamics NAV

ERP/Accounting

Epicor 10

ERP/Accounting

Sage Intacct

ERP/Accounting

Microsoft Dynamics BC

ERP/Accounting

AbleCommerce

eCommmerce

Microsoft Dynamics F&O

ERP/Accounting

SAP B1 HANA

ERP/Accounting

Sage BusinessWorks

ERP/Accounting

nopCommerce

eCommmerce

Miva

eCommmerce

X-Cart

eCommmerce

Web Jaguar

eCommmerce

Dynamicweb

eCommmerce

Zoho Invoice

ERP/Accounting

OpenCart

eCommmerce

We’re proud to power payments for 400,000+ businesses that make our days happy and bright. Snuggle up with a warm cup of coffee, spread some joy with

mustard, cozy up your home with a new

candle, and enjoy the lovely scent of

.

We’re proud to power payments for 400,000+ businesses that make our days happy and bright. Snuggle up with a warm cup of coffee, spread some joy with

mustard, cozy up your home with a new

candle, and enjoy the lovely scent of

.

B2B Businesses

B2C Businesses

EBizCharge has partnered with technology giants across the U.S. to build integrated payment solutions that fit the exact needs of their customer base.

400+ tech and

business partners.

400+ tech and business partners.

EBizCharge has partnered with technology giants across the U.S. to build integrated payment solutions that fit the exact needs of their customer base.

No risk. No better time to

get started.

No risk. No better time to get started.

No hidden fees | $0 support costs | $0 cancellation costs