EMV and the liability shift

As the payment processing industry is moving fast to comply with the new EMV standards that will begin in October 2015, many merchants have expressed concerns about the shift in liability and circumstances in which they’ll be responsible for any fraudulent transactions.

This article provides an overview to help merchants better understand and get ready for these changes in the payment processing industry.

As a business, you can be processing credit cards in one of these three ways:

- Processes payments through an integrated solution for an ERP/accounting/billing system and only use a virtual terminal to store and process customers’ credit cards. Your business does not have a storefront and does not accept cards from customers in-person.

- Processes payments via a virtual terminal AND physical terminal(s) by swiping customers’ credit cards in your business store front

- Processes credit cards via a physical terminal only.

Liability and your business

You are NOT liable:

If your business only uses a software integration to save card information and process cards inside an ERP/accounting/billing system and never handles actual cards. EMV will NOT affect you or your business and you’ll NOT be liable for any transaction frauds arising out of the new rules on EMV.

You can be liable:

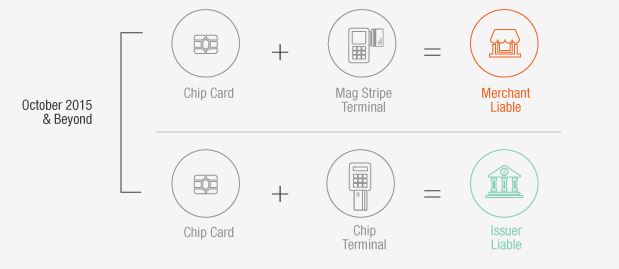

If you are a merchant with business storefront or use physical terminals to swipe credit cards. You’re only liable if you are presented with a chip card and you do not have the EMV enabled terminal to read the chip-embedded card.

How to avoid liability if you use physical terminals to accept payments?

If you process customer credit cards in person and manually swipe the cards, it’s time to upgrade to new EMV terminals. Accepting cards through an EMV enabled machine (if you have a storefront) is the only way you can avoid liabilities in case of a fraud in terms of the new EMV related rules.

Handling physical cards is the only way your business can be exposed to liability if:

Customer hands you a chip card,

AND

you process the card through an old mag-reader terminal,

AND

the customer files a dispute (chargeback),

AND

in lack of other evidences to establish the legitimacy of the transaction, it’s proved that you did not have the equipment to read the chip card.

For more information please contact our customer support team at 1-888-500-7798

Century Business Solutions is a merchant processor specialized in payment processing solutions for ERP/accounting systems and a proud member of Specialty Equipment Market Association.